Stop building average features for average users

Over my career, I have watched product teams build features that no one asked for. The culprit is almost always the same: they think of “customers” as one big blob. But customers are not a monolith. A first-time user has completely different needs than a power user. A startup founder cares about different things than an enterprise procurement manager. Treating them the same is a recipe for building something mediocre for everyone.

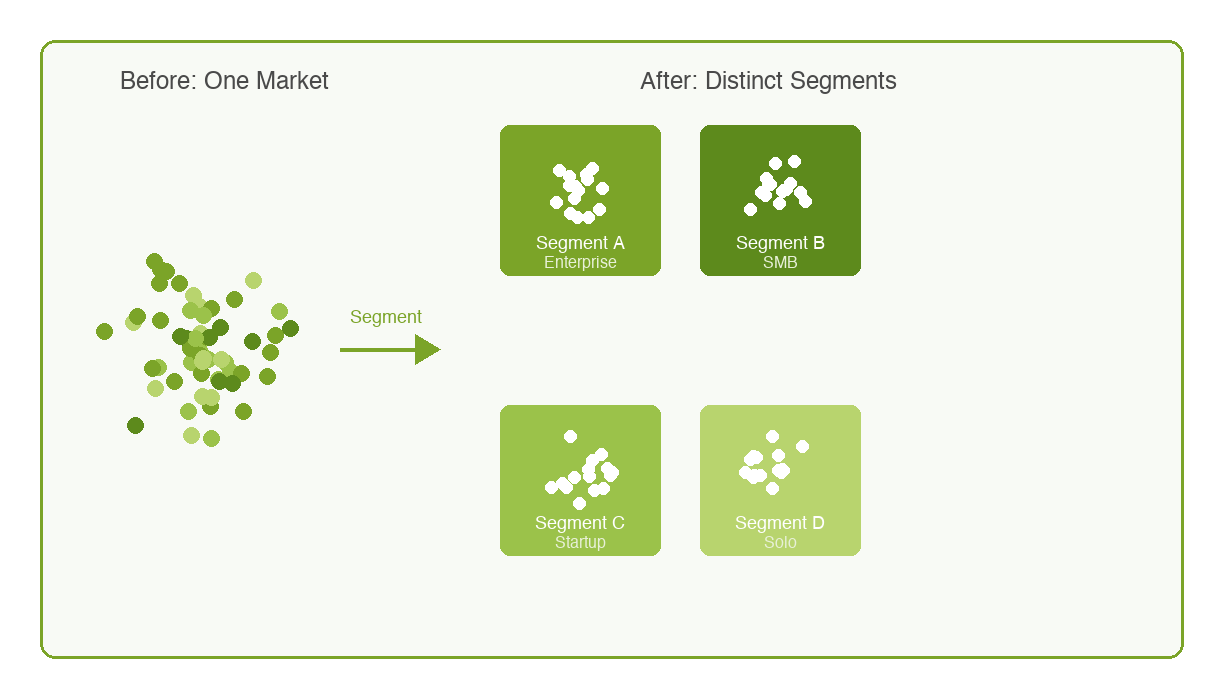

Customer segmentation is the practice of dividing your customer base into distinct groups based on shared characteristics. It sounds simple, but getting it right is surprisingly hard. And getting it wrong has consequences that ripple through your entire product.

Why Segmentation Matters for Product Managers

In the 5Ps framework, customer segmentation sits squarely in the Problem phase, under Customer Needs. Before you can define what to build, you need to understand who you are building for. And “who” is rarely just one type of person.

Here is what I have learned: the best product decisions come from knowing exactly which segment you are optimizing for—and which ones you are explicitly not optimizing for. That second part is just as important. If you try to please everyone, you end up pleasing no one.

Segmentation gives you permission to say no. When a loud customer requests a feature, you can ask: “Which segment does this serve? Is that segment our priority right now?” If the answer is no, you have a principled reason to defer it.

Common Segmentation Models

There are many ways to slice your customer base. In my experience, the best approach depends on your product and market. Here are a few models I have found useful:

Demographic Segmentation

This is the most basic approach. You group customers by characteristics like company size, industry, geography, or job title. It is easy to measure and often a reasonable starting point.

The problem is that demographics don’t always predict behavior. Two companies with 500 employees might have completely different needs if one is a fast-moving startup and the other is a traditional manufacturing firm.

Behavioral Segmentation

This groups customers by what they actually do with your product. How often do they log in? Which features do they use? How much do they spend? Behavioral segmentation is powerful because actions speak louder than demographics.

The challenge is that you need good data. If you don’t have robust analytics, behavioral segmentation is mostly guesswork.

Needs-Based Segmentation

This is my favorite. You group customers by the problem they are trying to solve—the “job to be done,” as Clayton Christensen famously put it. Two customers might look completely different on paper but have the exact same underlying need.

The downside is that needs-based segments are harder to identify and target. You can’t buy a mailing list of “people who need faster reporting.”

Value-Based Segmentation

Here you group customers by how much they are worth to you. High-value customers get white-glove treatment. Low-value customers get self-serve. This is useful for resource allocation, but it can feel cynical if you are not careful.

A Concrete Example: TaskMaster

To make the discussion more concrete, let’s pick a specific example. Imagine a B2B SaaS company called “TaskMaster” that sells a project management tool.

They started by targeting “small businesses,” which seemed clear enough. But after a year, they noticed something odd. Some customers loved the product and renewed enthusiastically. Others churned after a month and left angry reviews. The product hadn’t changed. What was going on?

When they dug deeper, they found that “small businesses” actually contained three distinct segments:

Creative Agencies — Small teams (5-15 people) managing multiple client projects. They cared most about client collaboration and beautiful, shareable project views. They were willing to pay a premium for polish.

Solo Consultants — One-person shops juggling many clients. They wanted simplicity and speed. Every extra click was painful. They were price-sensitive.

Tech Startups — Fast-growing teams (10-50 people) with engineering-heavy workflows. They wanted integrations with GitHub and Slack. They cared about API access and automation.

These three groups had completely different needs. The features that delighted Creative Agencies (fancy client portals) annoyed Solo Consultants (too much setup). The integrations that Tech Startups demanded were irrelevant to everyone else.

TaskMaster had to make a choice. They couldn’t optimize for all three. They decided to focus on Creative Agencies because that segment had the highest willingness to pay and the best product-market fit. The product got better because they stopped trying to serve everyone.

How to Choose Your Segments

There is no formula for picking the right segments. But here are a few questions I ask:

Can you actually reach them? A segment that sounds great on paper is useless if you have no way to find or market to those people.

Are they big enough to matter? A hyper-specific segment might have perfect product-market fit, but if there are only 50 potential customers in the world, you have a problem.

Will they pay enough? Some segments are large but price-sensitive. Others are small but have deep pockets. Both can work, but you need to know which game you are playing.

Can you serve them better than alternatives? If a segment already has great options, winning them over is an uphill battle. Look for underserved segments where you can be the obvious choice.

The Segmentation Trap

One warning: segmentation can become an excuse for analysis paralysis. I have seen teams spend months debating personas and segments without ever talking to real customers.

Segmentation is a tool, not an end in itself. The goal is to make better product decisions, not to create the perfect taxonomy. Start with a rough hypothesis, validate it with actual customer conversations, and refine as you learn.

How to Use With AI

This is where Generative AI shines. It is terrible at making the strategic choice for you (it doesn’t know your business strategy), but it is incredible at pattern matching large datasets and simulating empathy.

Here are three concrete ways to use GenAI to sharpen your segmentation:

1. The “Unstructured Data” Miner

Product managers often sit on mountains of qualitative data—sales call recordings, support tickets, and open-ended survey responses—that are too time-consuming to analyze manually.

The Workflow:

- Export your raw text data (e.g., last 100 negative reviews or sales call transcripts).

- Use a prompt like this:

“I have pasted 50 customer complaints below. Cluster them into 3-4 distinct groups based on the underlying problem they are trying to solve, not just the feature they are complaining about. For each group, give it a persona name and describe their ‘Job to be Done’.”

Why this works: LLMs excel at semantic clustering. They can see that “I can’t export to PDF” and “My client can’t see the dashboard” are actually the same segment: “Agency Owners needing client reporting.”

2. The “Synthetic User” Interview

Once you have a hypothesis for a segment, you can create a “synthetic user” to test your assumptions before you ever talk to a human. This helps you refine your interview questions.

The Workflow:

- Define the persona in the prompt.

“You are a ‘Solo Consultant’ who manages 5-10 clients. You are price-sensitive, hate complexity, and value speed above all else. I am going to pitch you a new feature. React honestly as this persona.”

- Pitch your idea.

- Ask the AI: “What is the first question you would ask me? What is your biggest hesitation?”

Why this works: It allows you to “stress test” your value proposition. If the AI (acting as the persona) shrugs at your feature, a real human in that segment likely will too.

3. The “Messaging Mirror”

Different segments need to hear different things to buy the exact same product. Use AI to rewrite your pitch for each segment.

The Workflow:

- Paste your generic value proposition.

- Prompt:

“Rewrite this value proposition for the ‘Tech Startup’ segment. Focus on API extensibility and automation. Use technical language.”

“Now rewrite it for the ‘Creative Agency’ segment. Focus on visual design and client impressions. Use aspirational language.”

The Guardrail: AI is a mirror, not a crystal ball. It reflects the patterns in its training data (or the data you give it). It cannot tell you if a segment is financially viable or if they actually exist in your market. You must validate every AI-generated segment with real customer interviews and behavioral data. If the data doesn’t back it up, the segment is a hallucination.

Conclusion

Customer segmentation is one of those foundational practices that separates reactive product management from proactive product management. When you know exactly who you are building for, every decision gets easier. When you don’t, you are just guessing.

This is what has worked for me. Your segments will look different than mine. The important thing is to be intentional about it.

What do you think? How does your team approach segmentation? Comments are gladly welcome.